Cash 1 Blog

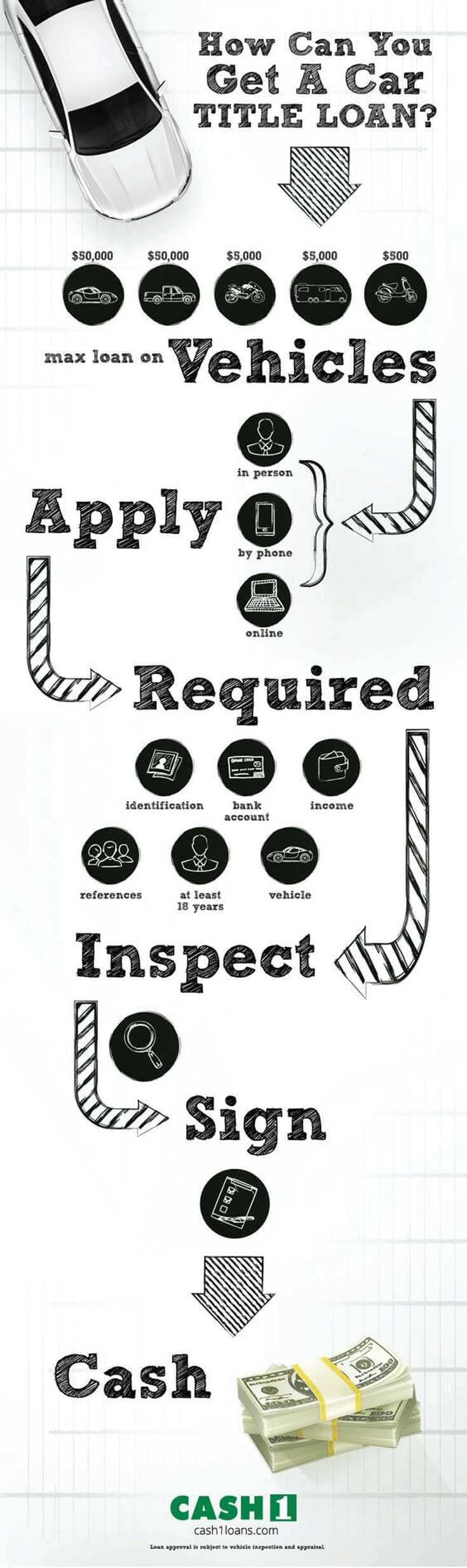

How To Get a Title Loan [Infographic]

Loans

Getting approved for a CASH 1 Title Loan is a pretty convenient way to get the cash you need when money is tight. Usually getting a secured loan on your vehicle title only takes 15 to 30 minutes. If you're needing to get cash from your car title you can avoid frustration and follow these steps on how title loans work to be prepared and be on your way to a quicker loan.

What Is a Title Loan?

Title Loans are also known as secured loans because the lender keeps your title as a promise for you to pay them back. A Title Loan uses the title of your vehicle as collateral to get you the money you need in a fast and convenient way. If your credit is bad or you have no credit at all this type of loan is a great solution.

A Title Loan Has a Maximum Amount

You can use many types of vehicle titles to get money. A car and truck are your best options while a scooter will limit your title loan amount drastically. Please remember that other factors, such as net income, will determine the maximum loan amount and payment options.

- Car Loans: up to $50,000

- Truck: up to $50,000

- RV: up to $5,000

- Motorcycle: up to $5,000

- Scooter: up to $500

Requirements for New Customers.

Convenient Ways to Get a Title Loan:

Getting pre-approved for a Title Loan can be achieved at one of our CASH 1 Nevada or Arizona locations or from your home by phone, computer, laptop, tablet or smartphone. But, keep in mind that you still have to visit a store in order for us to give your car a visual inspection. A trained representative will complete a vehicle evaluation to determine what we are able to lend.

- Online

- Phone

- Store

What You'll Need to Apply for a Title Loan:

- Vehicle

- Government Identification

- Proof of Income

- Bank Account Information

- At Least 2 Reference

- You can't be on active duty in any branch of the Military

- You Can't Live at an Extended Stay or Weekly

Inspection

When your vehicle is ready for inspection we need to verify that your vehicle matches your vehicle on the title. Also your VIN number on your vehicle must match the VIN number on your title.

Get Your Cash

Before you receive your money we suggest you read our 'Know Before You Owe' letter. Then, you sign the documents and we give you your cash.

Payments

Your payments will be due on every pay date that you have with your employer. Depending on your pay date, you will make payments weekly, bi-weekly, or monthly. When payments are made, they are first applied to any fees, unpaid interest that has accrued thus far, and finally to the Principal Balance. Your minimum payment amounts are depended on what loan term you choose and how often you get paid.

You Can Choose One of the following Payment Plans:

- 6 months

- 9 months

- 12 months

- 15 months

- 18 months

If you choose a smaller loan term, your loan will be paid off quicker and with less interest, but the minimum payments will be larger. If you choose a longer loan term, the loan will take longer to pay off and accrue more interest, but the minimum payments will be smaller. It is up to you to decide what schedule works best. You can make payments by cash, credit/debit cards, or auto payments.

Auto Payments for Your Title Loan

Auto payments are a convenient way to make sure your payments are on time. It gives you the option of setting up an alternate direct deposit with your HR department so that your payment is directly deposited into your CASH 1 account on each one of your pay dates. Setting this up can decrease your interest rate and increase the amount you qualify for. You won't have to come in and make any payments in the store.